Top 5 highest grade mine

GEOGRAPHY & ENVIRONMENT

Geography

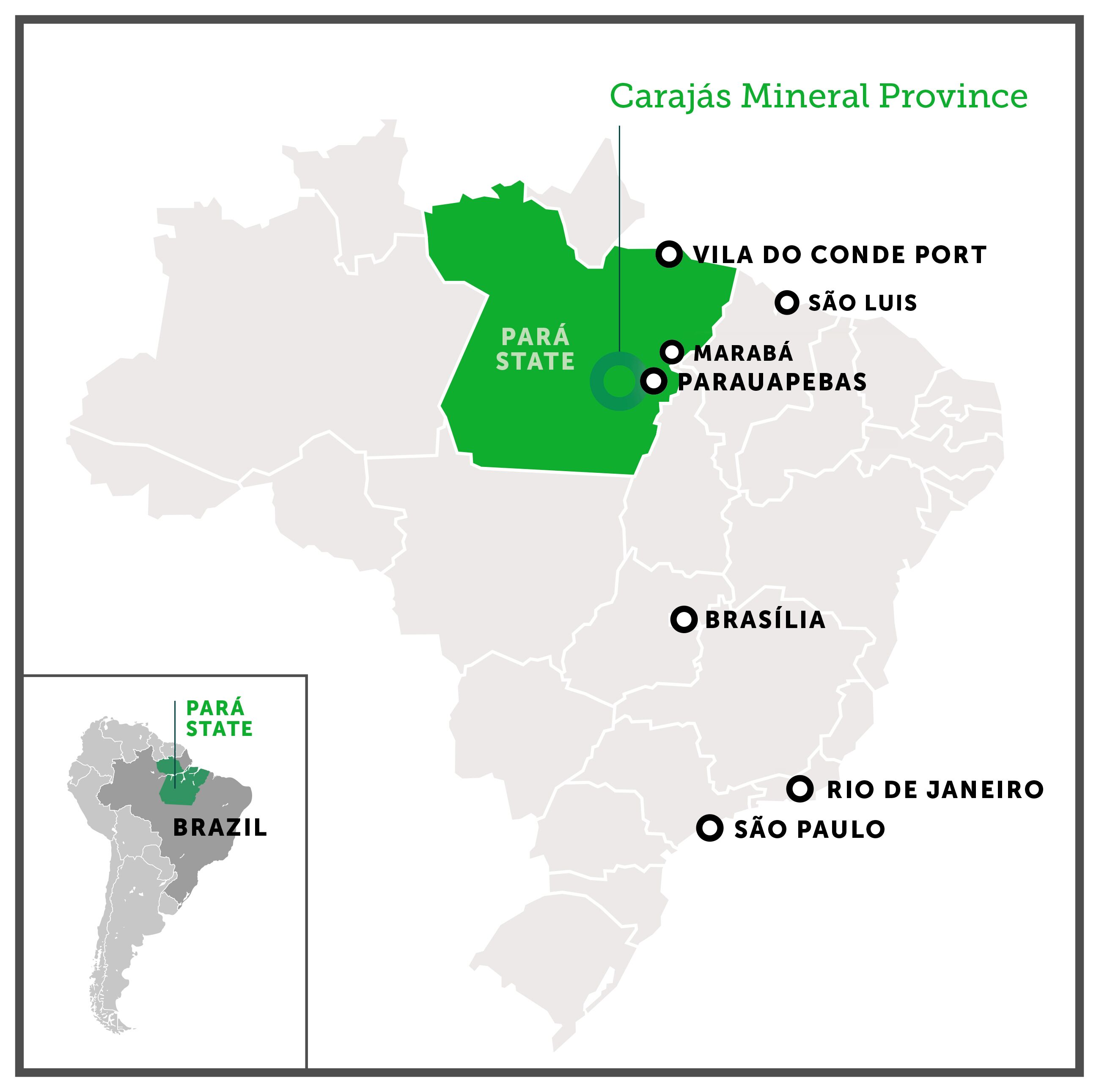

Antas is located in the Carajás, 25 kilometres southeast of Parauapebas, in the state of Pará in the Northern region of Brazil.

The Carajás is one of the world’s premier iron-oxide-copper-gold (IOCG) mineral provinces. The region is host to the world’s largest iron ore mine and sizeable copper gold mines.

Parauapebas is a well-developed city built on mining. Considered to the fastest growing city in Brazil, with a population estimated at over 250,000, the city offers all the fabrication, engineering and support services expected of any large mining-focussed city globally. Parauapebas also benefits from a domestic airport 18km away with direct flights to the national capital Brasília and de facto mining capital Belo Horizonte for international connections. Paved highways and freight-rail lines also connect the city to regional capitals and world-class ports, thus facilitating easy imports of equipment and exports of mineral products.

.

Antas benefits strategically from its situation. Just 30 minutes away from Parauapebas, the company’s founders knew that to ensure the timely and low-cost development and day-to-day running of the operation, it is important not to be remotely situated and endure the challenges of geography. Today, the workforce at Antas drive in for their shifts, and can drive home again at the end of their day. Equally when additional services, such as engineering support for example, are required, help is usually close by.

Environment

Antas is located on low hilly ground.

The climate in the region is tropical and humid with two distinct seasons. The dry season extends from June to September and the rainy season from October to May. Annual rainfall is approximately 1,600mm.

The area is used heavily for cattle farming. Indeed, the state of Pará represents almost 10% of the entire Brazilian cattle industry, producing an estimated 18.7 million head of cattle a year.

GEOLOGY

Regional Geology

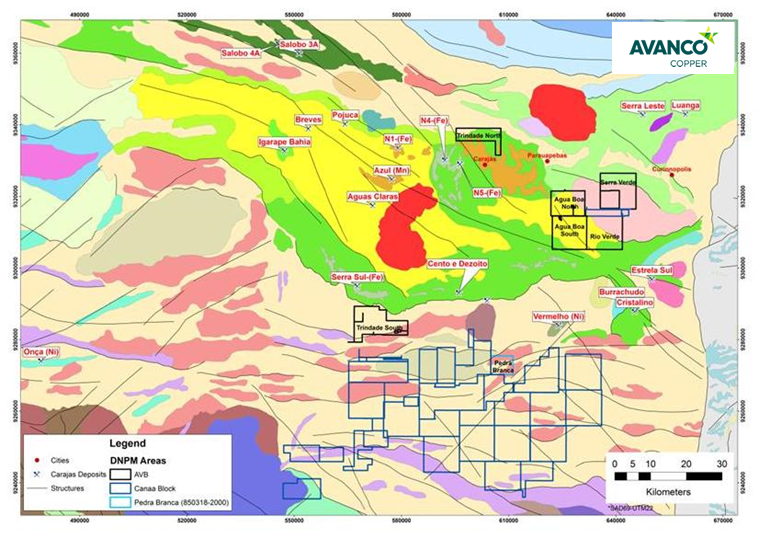

The Carajás Mineral Province (CMP) is located in the southern part of the Amazon Craton, which is one of the largest cratonic areas in the world. This province is divided into two tectonic blocks, the southern Rio Maria greenstone terrain, and the northern Itacaúnas Shear Belt. Within the northern block of the CMP, the basement rocks are overlain by metavolcanic–sedimentary units of the Rio Novo Group and the Itacaiúnas Supergroup (Igarapé Salobo, Igarapé Pojuca, Grão Pará, and Igarapé Bahia Groups, which form the Archean Carajás Basin).

The Itacaiúnas Supergroup hosts all the Carajás IOCG deposits and is thought to have been deposited in a marine rift environment. The metamorphism and deformation of this supergroup has been attributed to the development of the Itacaiúnas shear zone and to the Cinzento and Carajás fault systems. Granites, mafic–ultramafic layered complexes, as well as gabbro dikes and sills, intrude the Itacaiúnas metavolcano–sedimentary sequence.

The CMP contains a number of different ore deposit types and represents one of the best-endowed mineral districts in the world, but principally is hosts the world’s largest known concentration IOCG deposits (e.g., Sossego, Salobo, Igarapé Bahia-Alemão, Cristalino, Gameleira, Tarzan and 118).

Carajás IOCG deposits display a number of similarities including: (1) variable host rock lithologies; (2) association with shear zones; (3) proximity to intrusions of different compositions; (4) intense hydrothermal alteration; (5) magnetite formation followed by sulphide precipitation; and (6) a wide range of fluid inclusion homogenization temperatures (100–570°C) and salinities (0 to 69 wt% NaCl eq.) in ore-related minerals.

The CMP is also host to:

- Small, shear zone- related, lode-type gold and Au–Cu–Bi–Mo deposits in the southern portion of the CMP

- The world class Carajás iron ore deposits (e.g., S11D) in the northern portion of the CMP

- Chrome–PGE deposits (e.g., Luanga)

- Lateritic nickel deposits (e.g., Vermelho, Onça-Puma) associated with mafic–ultramafic complexes

- High grade manganese deposits in the central and northern CMP (e.g., Azul and Sereno)

- Intrusion-related Cu–Au–(Mo–W–Bi–Sn) and W deposits associated with anorogenic granite intrusions

- Au–Pd–Pt at the Serra Pelada deposit, which became famous in a spectacular early 1980’s gold rush.

The main structural trend at Rio Verde is WNW-ESE and is related to the regional Carajás fault (shear zone) to the south (NW-SE) and the Cinzento shear system (WNW-ESE) to the north, which are integral parts of the Itacaiúnas Belt. These WNW structures are probably the main conduits through which the granitic intrusives and the mineralised fluids ascended.

Local Geology and Mineralisation

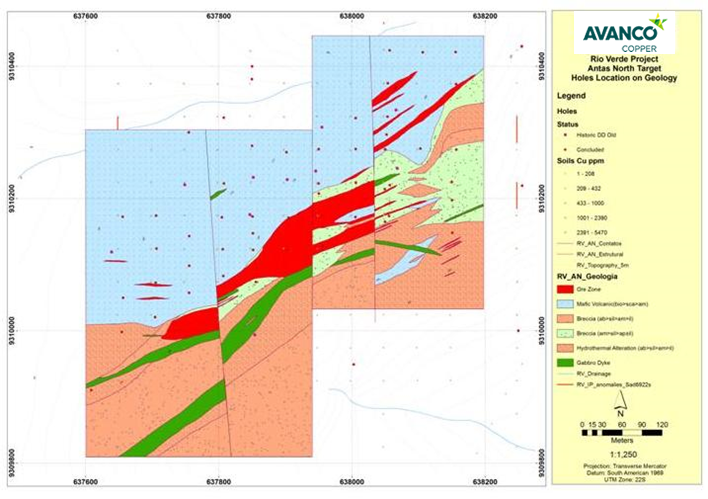

The Antas orebody is located close to the southern border of the Estrela Granite Complex and is hosted predominantly by mafic metavolcanic rocks, cut by gabbro dikes.

Associated alteration shows a moderate to strong zonation from the surrounding unaltered country rock into the most strongly mineralised portions of the deposit, while hydrothermal alteration zones similar to those recognised at other IOCG deposits in the Carajas; early regional sodic alteration (albite-scapolite) followed by potassic (biotite) and calcic alteration (actinolite– cummingtonite). The complex stages of sodic, sodic–calcic, potassic, and hydrolytic alteration observed at Antas North are generally similar to those described by Monterio and Xavier (2008) from the Sossego – Sequeirinho IOCG system in Carajás.

The main orebody is oriented northeast and coincides with the main soil anomaly (>1,000ppm copper) and electromagnetic anomaly. Zones of massive sulphide near the periphery of the ore zones help to generate the high-grade intercepts, typically seen n results reported historically.

Copper-Gold Mineralisation

The majority of mineralisation is concentrated within a steeply dipping body that contains fragments of massive sulphide and disseminated sulphide minerals, within a matrix of hydrothermal breccia.

Massive Sulphide High Grade Zone

Massive Sulphide High Grade Zone contains variable proportions of chalcopyrite and pyrrhotite as dominant minerals. Chalcopyrite is by far the most abundant sulphide, forming a massive aggregate. Sulphide veins are usually not deformed, and planar.

Medium-High Grade Zone;

The Medium-High Grade Zone also contains variable proportions of chalcopyrite, pyrrhotite, as dominant minerals, and is by far the most abundant of the mineralised zones. Sulphides frequently form the matrix of hydrothermal breccia’s.

Disseminated Low Grade Zone.

In the Disseminated Zone chalcopyrite occurs as fine-medium grained disseminations in the transparent gangue, usually surrounding transparent minerals. Sulphides also occur as fracture fill and as small blebs. Commonly this ore type occurs between narrow Medium-High grade and Massive Sulphide zones.

Reserves and Resources

The Mineral Resource and Ore Reserve estimates are currently undertaken by the Company’s technical staff, in consultation with independent external professionals. A summary of the governance and controls applicable to the Company’s mineral resource and ore reserve process is as follows:

- Review and validation of drilling and sampling methodology and data spacing, geological logging, data collection and storage, sampling and analytical quality control;

- Review of known and interpreted geological structure, lithology and weathering controls

- Review of estimation methodology relevant to the mineralisation style;

- Visual validation of block model against raw data; and

- Internal peer review by senior company personnel.

The review process has not identified any material issues or risks associated with the existing Mineral Resources and Ore Reserve estimates. The Company periodically reviews the governance framework in line with the expansion and development of its business.

“Discovered, developed and managed by Avanco”

Depleted Antas North JORC Mineral Resource and Reserve Statements, as at 31 December 2016

| Mineral Resources (Grade Tonnage Reported above a Cut-off Grade of 0.9% Copper) | |||||

| CATEGORY | MILLION TONNES | Cu % | Au (ppm) | COPPER METAL (T) |

GOLD METAL (Oz) |

| Measured | 1.96 | 3.42 | 0.76 | 67,000 | 48,000 |

| Indicated | 1.61 | 2.23 | 0.42 | 36,000 | 22,000 |

| Inferred | 1.89 | 1.59 | 0.23 | 30,000 | 14,000 |

| TOTAL | 5.46 | 2.43 | 0.48 | 133,000 | 84,000 |

| Ore Reserves | |||||||

| JORC CATEGORY | ECONOMIC CUT-OFF Cu% | MILLION TONNES | COPPER (%) |

GOLD (g/t) | COPPER METAL (T) |

GOLD METAL (Oz) |

|

| Antas Mine | Proved | 0.65 | 1.23 | 3.34 | 0.73 | 41,100 | 28,900 |

| Probable | 0.65 | 1.69 | 2.16 | 0.47 | 36,500 | 25,500 | |

| Mine Stockpiles | Proved | 0.65 | 0.12 | 2.26 | 0.53 | 2,800 | 2,100 |

| TOTAL PROVEN & PROBABLE | 3.04 | 2.64 | 0.58 | 80,400 | 56,500 | ||

MINING

Works at the Antas Mine started in August 2015. The current man plan it is to operate over 3 stages to maintain a consistent supply of ore over the life-of-mine. Based on the current reserves model, the mine will operate until 2021, however, a drilling programme announced in April 2017 is targeting to increase mineral resources and reserves to potentially increase production and extend mine life.

The life-of-mine strip ratio is 6.4, and at full scale, the mine will be 650 metres in length, 350 across and 250 meters deep. The surrounding rock is very massive and very competent allowing 80° wall angles degree walls, 10-20 metre benches with 6 meter berms with an overall slope angle of 55° and ramps at 15°.

Mining is contracted to Mining And Civil Australia (MACA), a well-known and respected contractor with activities in Australia Brazil. A conventional mining method is employed with load and haul. The mine operates over three shifts, 24 hours a day, 365 days. All of the operational mining personnel are Brazilian nationals and residents, with no fly-in-fly-out operators. Avanco provides technical support for operations, including engineering, geological and survey control.

Average monthly production is approximately 210,000 banked cubic metres. Explosives are provided by a down the hole service provider averaging 180 tonnes of emulsion monthly.

Modern Mining Fleet

The mining is undertaken with a newly purchased fleet tailored the operation and comprising:

- Liebherr R9100 Excavators: 120t class excavator in backhoe configuration, 565kW, 7.6 metre cubed rock bucket

- Volvo A40F articulated off road haul trucks: 6-wheel drive, which is excellent for wet weather conditions, 40 km/hr, with a nominal 40 tonne payload, equal to [14] cubic metres

- Caterpillar 5150 top hammer drill rigs: 32kw Hammer, 97-115mm drill diameter, averaging 22 meters per hour

- Auxiliary equipment: including front-end loaders, dozers, graders, water carts and service trucks.

Mining Process

Grade control drilling:

- Critical step in ore mining control and planning

- Drilling 5 x 10 metre drill pattern at 30 metre vertical depths

- Infill drilling 15 x 10 at 50 metre drilling (every third hole) to overlap drilling

- Drilling completed by reverse circulation

- Geological model created in Surpac Mine planning Software

Blast hole drilling:

- Drilling and blasting completed on 5 metre benches

- Conventional drill and blast techniques with staggered drill pattern

- Drill parameters change with material characteristics

- Drill hole cuttings are sampled to added further geological data for grade control due to the geological nature of the ore body

- Average 3-4 blasts each week

Mining:

- Mining is completed in 2.5 metre flitches (passes)

- Ore mining is visually controlled by in-field geological technicians with survey control marking up ore boundaries defined by both blast hole sampling and geological models

- Ore is designated by copper content and individually stockpiled on the Run of Mine stockpiles (ROM pad) so to maintain consistent copper grades

- Waste is stockpiled in single location in 10 metre high benches

PROCESSING

The Antas Processing Plant was designed on a lean budget, indeed, it was completed ahead of schedule and below budget due to the ingenuity of the design team. Today it operates at above capacity, exceeding every expected KPI metric.

Construction

The Plant was constructed with many major components being sources second hand, for example the mill which was second hand but unused. The entire flotation circuit was also acquired second hand. This lowered many costs by over half, whilst significantly reducing delivery lead times.

Taking advantage of specialist equipment manufacturing expertise in Belo Horizonte and São Paolo, some sections of the plant were designed to be trailer-mobile, then trucked to site complete, where they were mounted on foundation bases directly and connected to power, air and water ready for operation. This reduced site installation time and facilitated a rapid commissioning period.

Although constructed on a shoestring, the Plant comprises some of the best equipment, for example Metso ball mill, Outotec floatation cells and Denver cleaner cells, all procured at lower than usual costs and assembled quicker than industry norms.

Operating

The Processing Plant has operated above capacity since day one, and today continues to beat expectations, for example: the throughput capacity operated at 20% above original design capacity; copper production 17% ahead at 14,000 annual copper tonnes; copper recoveries 2% higher at 97%.

The plant was deliberately designed to be flexible, with the opportunity for a doubling in capacity for under approximately $20 million, should additional feed be developed or acquired at or near to Antas.

Finally, the very clean concentrate produced, is highly sought after by blenders and consequently attracts treatment and refining charge discounts.The Antas Processing Plant was designed on a lean budget, indeed, it was completed ahead of schedule and below budget due to the ingenuity of the design team. Today it operates at above capacity, exceeding every expected KPI metric.

PRODUCTION & GUIDANCE

2017 Guidance

Annual production targets for 2017 are 13,500 to 14,000 tonnes of copper in addition to 9,750 to 10,500 ounces of gold in concentrate.

Average annual production costs for 2017 are forecast to be a C1 Costs of between$1.35 to $1.50 / lb payable copper and an all In Sustaining Cash Cost (AISCC) of between $1.65 to $1.80 / lb payable copper.

2016 Actual Production

The Antas Mine achieved first production in May 2016, producing first concentrate in June 2016 and declaring commercial production in July 2016, ahead of schedule.

Although not a full production year, Antas produced 11,188 tonnes of copper and 7,779 ounces of gold in 2016, exceeding guidance in its first year.

Full production statistics for 2016 are:

| JORC CATEGORY | UNITS | 2016 |

| Total Material Mined | t | 6,497,037 |

| Ore Mined | t | 629,026 |

| Copper Grade | Cu % | 2.24 |

| Gold Grade | g/t | 0.67 |

| Tonnes Processed | t | 510,830 |

| Copper Grade | Cu % | 2.29 |

| Gold Grade | g/t | 0.55 |

| Copper Recovery | % | 95.76 |

| Gold Recovery | % | 85.81 |

| Concentrate | DMT | 39,794 |

| Contained Copper | t | 11,188 |

| Contained Gold | Oz | 7,779 |

| Concentrate Copper Grade | Cu % | 28.11 |

| Concentrate Gold Grade | g/t | 6.08 |

COPPER CONCENTRATE SALES & LOGISTICS

The copper concentrates produced for sale at the Antas mine are rated within the industry as very clean medium grade concentrates with negligible impurity levels. Typically they average around 28% copper content, 5 g/t gold and 20 to 30 g/t silver with no impurities of any consequence.

Copper concentrates are produced by mines around the world for processing into copper metal by copper smelters and refineries. In 2016 world copper smelter production was about 17 million tonnes of copper, of which 10 million tonnes was produced by Asian smelters, of which 6 million was produced in China.

The very clean Antas concentrates are highly desirable to both traders and smelters around the world as they are used to blend down poorer quality concentrates with high impurity levels such as arsenic produced by other mines, particularly those in South and Central America. The overall blend is key to an efficient smelting process and also to meeting the stringent restrictions on impurity levels on the import of copper concentrates into China.

The Avanco sales and marketing team capitalise on the intrinsic competitive advantages of the clean Antas product and achieve superior sales prices and terms and thereby achieve some of the lowest treatment charges and refining charges in the market place. Currently, all Antas product is sold and delivered into the large Asian market to both trader blending operations and Chinese smelters.

Avanco also benefits from a very efficient and cost competitive logistics process from minesite to customer in sealed containers. Importantly this process ensures that Avanco experiences none of the product handling losses that are typically experienced with bulk shipping. Avanco currently uses one of the major international container lines for shipping. About 40 containers a week are trucked from the port area of Vila do Conde to the Antas mine site, loaded with the concentrates and returned to the Port of Vila do Condoe for weekly sailings to Asia.